20+ 30 year amortization

View complete amortization tables. Type the month and year of the first loan payment in cell A8.

3

Amortization as a way of spreading business costs in accounting generally refers to intangible assets like a patent or copyright.

. So what is the amortization period. Since paying down the mortgage early seems to be so en vogue these days it makes sense to compare 20-year mortgages vs. Most mortgages will require a down payment amount upon closing.

It also determines out how much of your repayments will go towards. Amortization Schedule for a 300000 mortgage for 30 years with a 320 Percent Interest Rate Auto Loans Loan Summary Payment Summary Yearly Amortization Schedule Amortization. While both loan types have similar interest rate profiles the 20-year loan typically offers.

30-Year Amortization Although Finance Minister Jim Flaherty reduced the maximum amortization period from 30 years to 25 years 30-year amortizations are still an. Here are some of the advantages of a 20-year mortgage over a 30-year mortgage. Revolving loans such as those for credit cards dont.

Mortgages with fixed repayment terms of up to 30 years sometimes more are fully-amortizing loans even if they have adjustable rates. As we can see from the two scenarios the longer 30-year amortization results in a more affordable payment of 101337 compared to 152999 for the 15-year loana. Lets suppose you made a 20 percent down.

Mortgage terms were changed to have options longer than 15 years. Be sure to subtract this amount from your purchase price to obtain the actual amount of your loan. 1826 Total interest paid 327490 Total cost of loan 657490 Payoff date Sep 2052 Chart Schedule How payments change over the life of a 30-year loan As the term of your mortgage.

For example if you. You wont have to pay as much in interest over the life of your loan with a 20-year mortgage both because these loans typically come with a slightly lower interest rate than a 30. A 30-year term is 360 payments 30 years x 12 months 360 payments.

This technique can save borrowers a considerable amount of money. The mortgage amortization period is the total number of years it will take to pay your. Its the total amount of time it takes to pay off a loan.

The FHA went on to set restrictions on interest rates and terms and required fully amortizing loans. Most lenders tend to amortize personal loans over 3-5 years although nothing in the law requires this. Under Section 197 of US.

It does have a 5-year period a 20-year amortization length and a 6-percent interest rate. This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments. 392 rows The table below compares the interest rate APR monthly payment and total interest cost for 15 20 and 30-year fixed-rate mortgages.

Law the value of these assets can. How long you take to pay off the loan depends on the terms of the loan. For example a borrower who has a 150000 mortgage amortized over 25 years at an interest rate of 545 can pay it.

30-year mortgages The most common type. Instead of manually calculating the premium these factors can be entered into a.

Best 20 Loan Amortization Schedule Templates Excel Free Best Collections

20 Excel Spreadsheet Templates For Teachers Report Card Template Excel Templates Excel Spreadsheets Templates

1

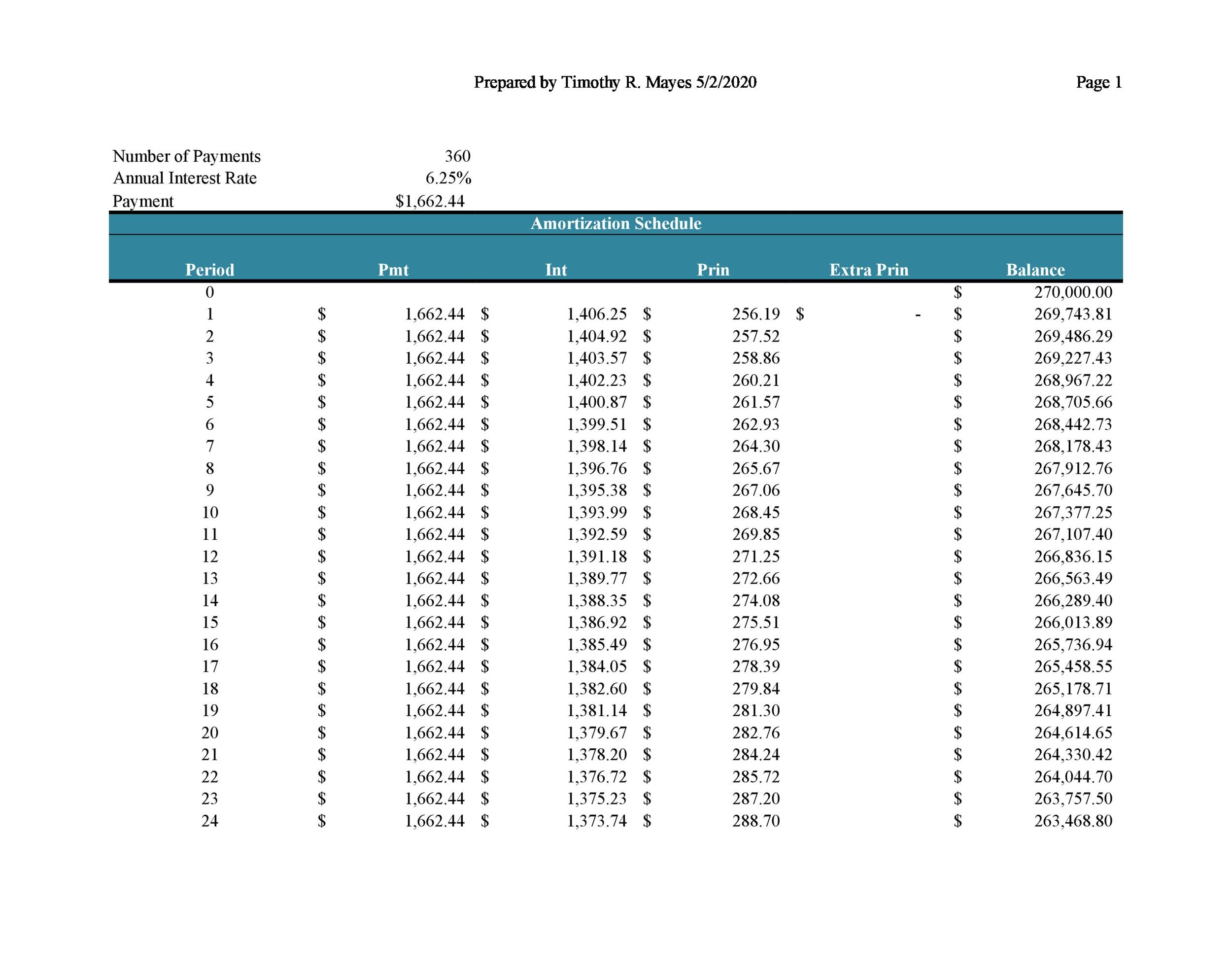

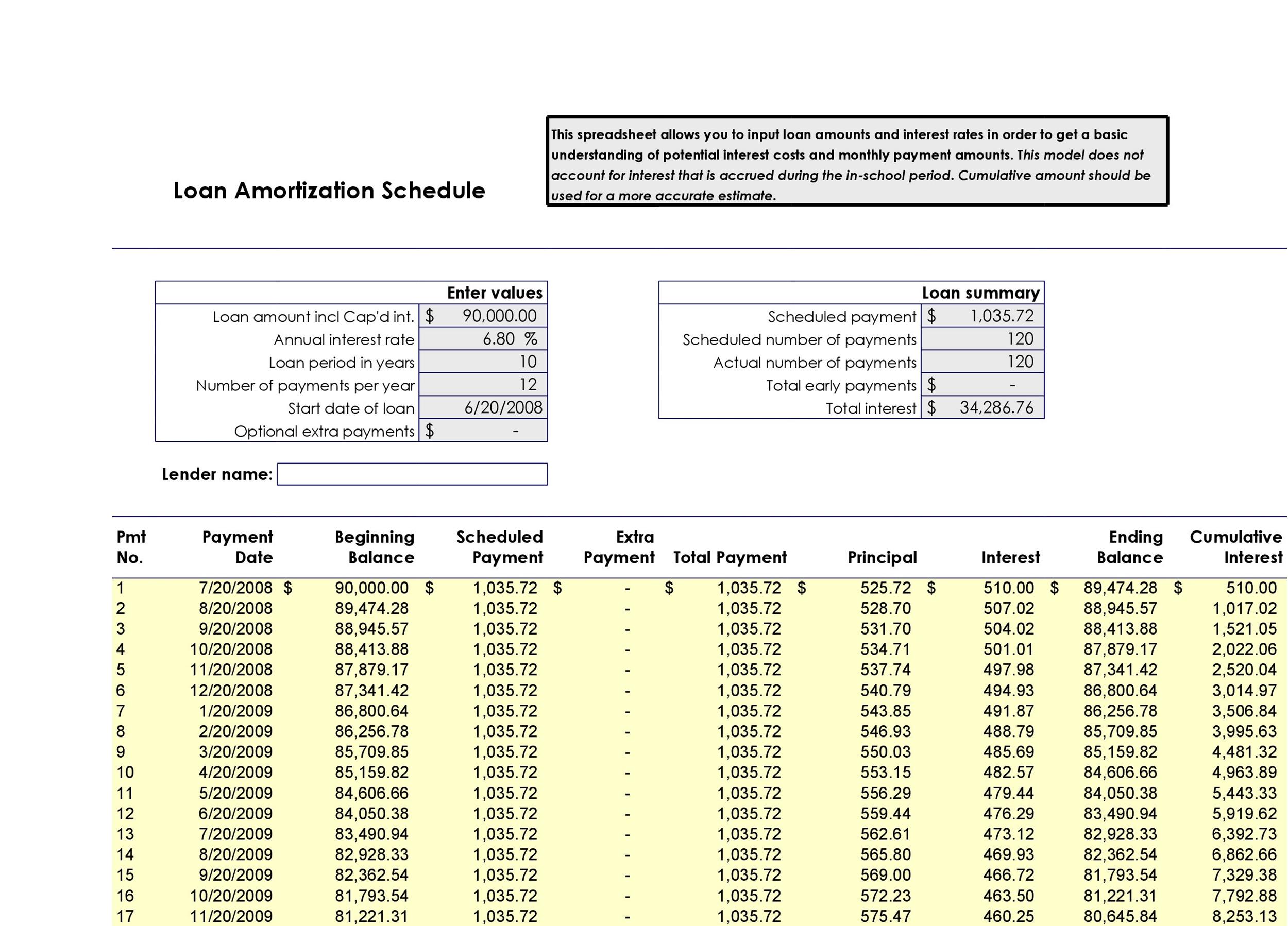

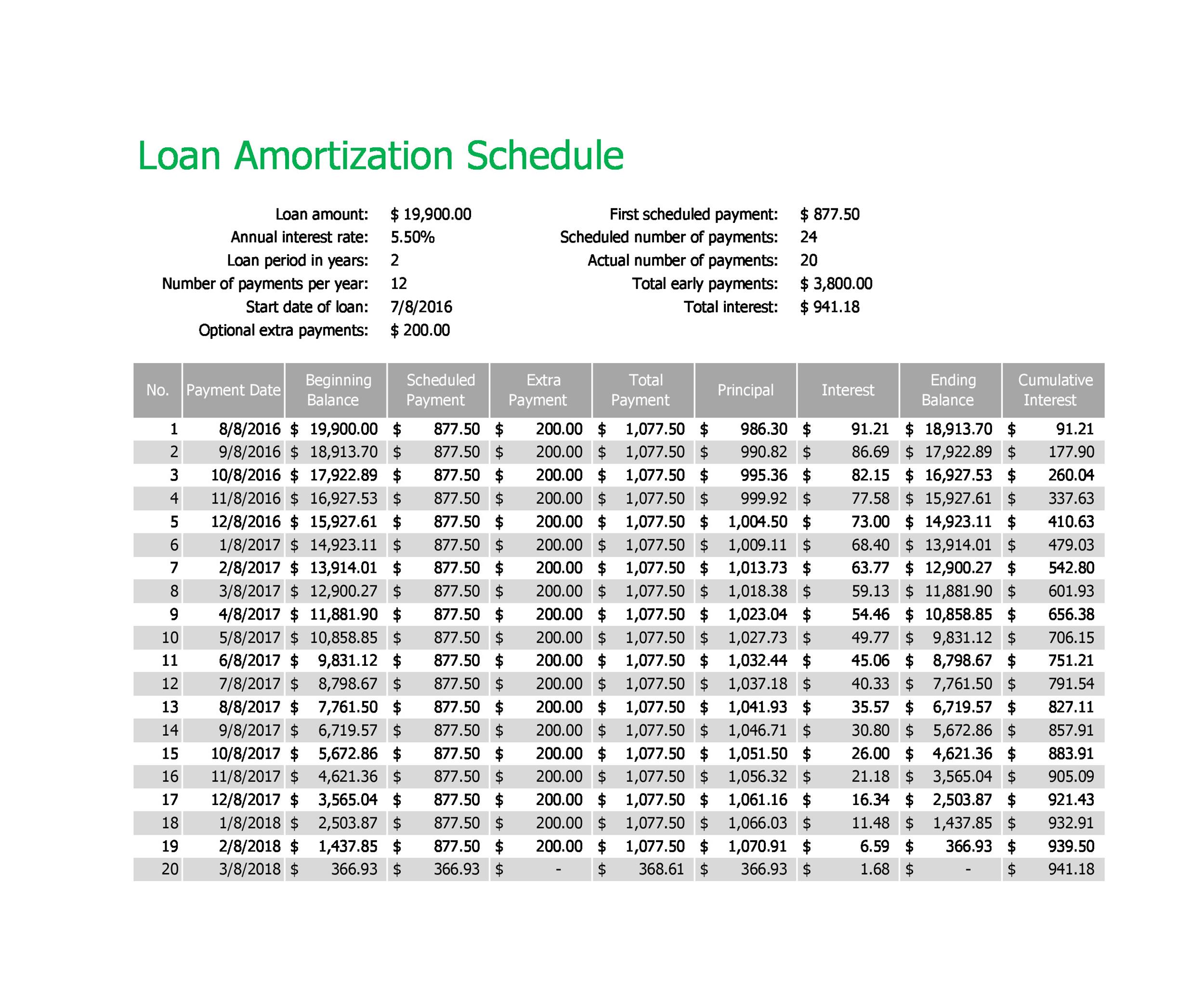

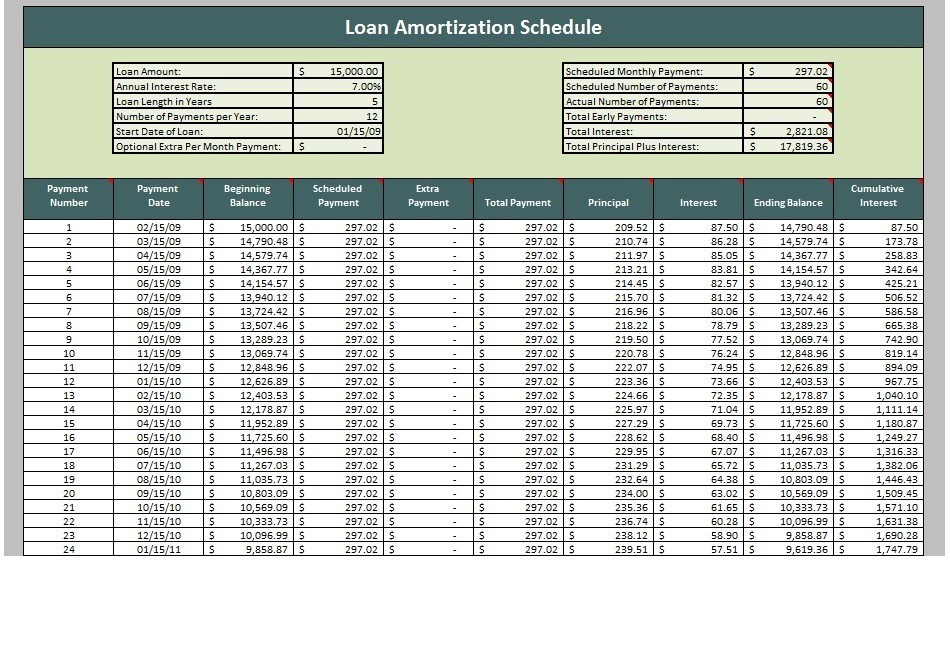

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

5 Day Week Calendar Template Excel Amortization Schedule Weekly Schedule Template Excel Schedule Templates

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

20 Blue Premium Powerpoint Presentation Templates Powerpoint Slide Designs Powerpoint Presentation Design Presentation Layout

/dotdash_INV_final-The-Risks-of-Mortgage-Backed-Securities-Mar_2021-01-d9076937fc9944049f46c85c78098e39.jpg)

The Risks Of Mortgage Backed Securities

What Happens To Interest Already Paid If I Re Finance A 30 Year Mortgage To 25 Years Quora

5 Reasons Why A 20 Year Mortgage Is A Great Option Credit Sesame

1

5 Reasons Why A 20 Year Mortgage Is A Great Option Credit Sesame

Printable Mortgage Factor Chart